It’s not a big court case that the Securities and Exchange Commission (SEC) needed in order to freeze the assets and begin recovery for the victims of the First Liberty Building and Loan Ponzi scheme. It’s a consent judgment, which means that Edwin Brant Frost IV agreed to that over lengthy litigation. The receiver recently released the court documents of the consent judgment of Michael Brown United States District Judge from July 11.

At The Citizen, we’re not lawyers, but we took a deep dive to see what 22 pages of legalese would bring to light in this case. As a reminder, the First Liberty Building and Loan went belly up and revealed a massive Ponzi scheme earlier this summer. With over 300 investors and $140 million defrauded from hapless people out of their offices in Newnan.

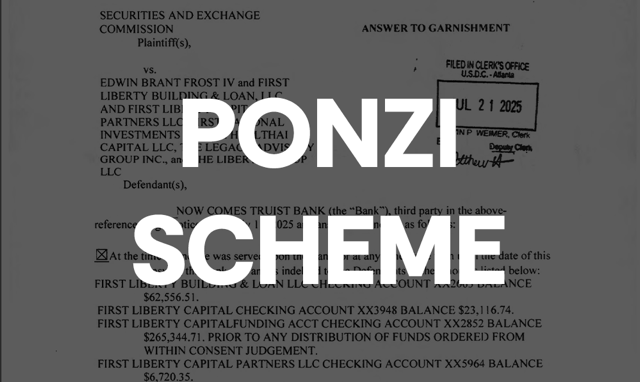

First the documents showed that the SEC garnished $1,270,000+ in 15 First Liberty-related accounts at Truist. Assets were also frozen in three personal accounts held by Brant Frost IV at United Community Bank and Unity Bank.

Edwin Brant Frost IV and First Liberty Building and Loan and all related companies were mentioned in the judgment. It stated that he is not allowed to conduct any fraud or sell any securities.

The judgment further froze all assets including real estate, although if you read this previous article in The Citizen, you’ll find that most of Frost’s property is in his wife’s name, and she’s not mentioned in the consent judgment.

The document also set up provisions for Frost to open up a Post Freeze bank account and allowed him to withdraw $20,000 a month from one of his accounts, presumably to pay his household expenses. The consent judgment also granted Truist the ability to pay Frost’s attorneys (Chalmers, Adams, Backer & Kauffman LLC) $34,733 directly.

Taking all the assets isn’t enough. The judgment states that banks, hedge funds, accounts, and other places where Frost may have stashed his cash are instructed to turn over details to the SEC and the receiver. And Frost is supposed to report every kind of account he has, including safety deposit boxes. On top of that, there will be fines. It states, “It is further hereby ordered, adjudged and decreed that The Defendants and Relief Defendants shall pay disgorgement of ill-gotten gains and prejudgment interest thereon, and that the Defendants shall pay civil penalties . . .”

Many people are wondering why the SEC or Secretary of State didn’t catch onto this massive fraud earlier. According to a recent article in the AJC, First Liberty was using a term that was out of use and no longer subject to legislative oversight, that of “Building and Loan.” Apparently, businesses stopped using that after the Great Depression and the 1940s. So while there is oversight for banks. Oversight for those that sell stocks. Oversight for those who sell mortgages. Oversight for nearly every kind of security sold. There was no one watching the thieves at First Liberty Building and Loan. And in that grey space, with no one watching, they walked off with $140 million.

They bilked investors like George, that we reported on previously, by offering guaranteed rates of return, 13% in his case. Purportedly they were lending money to businesses for building and improvement projects at high rates, because these folks wouldn’t qualify for bank loans. One could deduce that people who don’t qualify at the bank are probably the safest folks to lend to, and the records seen so far from First Liberty show that. Most of the loans they gave defaulted.

The Citizen reported previously that Brant Frost IV has vehicles worth approximately $500K, and homes and land worth approximately a million. We now know from this consent judgment that there was less than $1.3 million in their bank accounts. The Frosts gave away $1 million in political donations, and possibly also the same amount in charitable giving. So where’s the rest of the money? Was it tied up in belly up businesses they invested in? Tucked into rare coins, like one reporter said? We can even speculate that it might be hidden in crypto or off-shore accounts?

Leave a Comment

You must be logged in to post a comment.