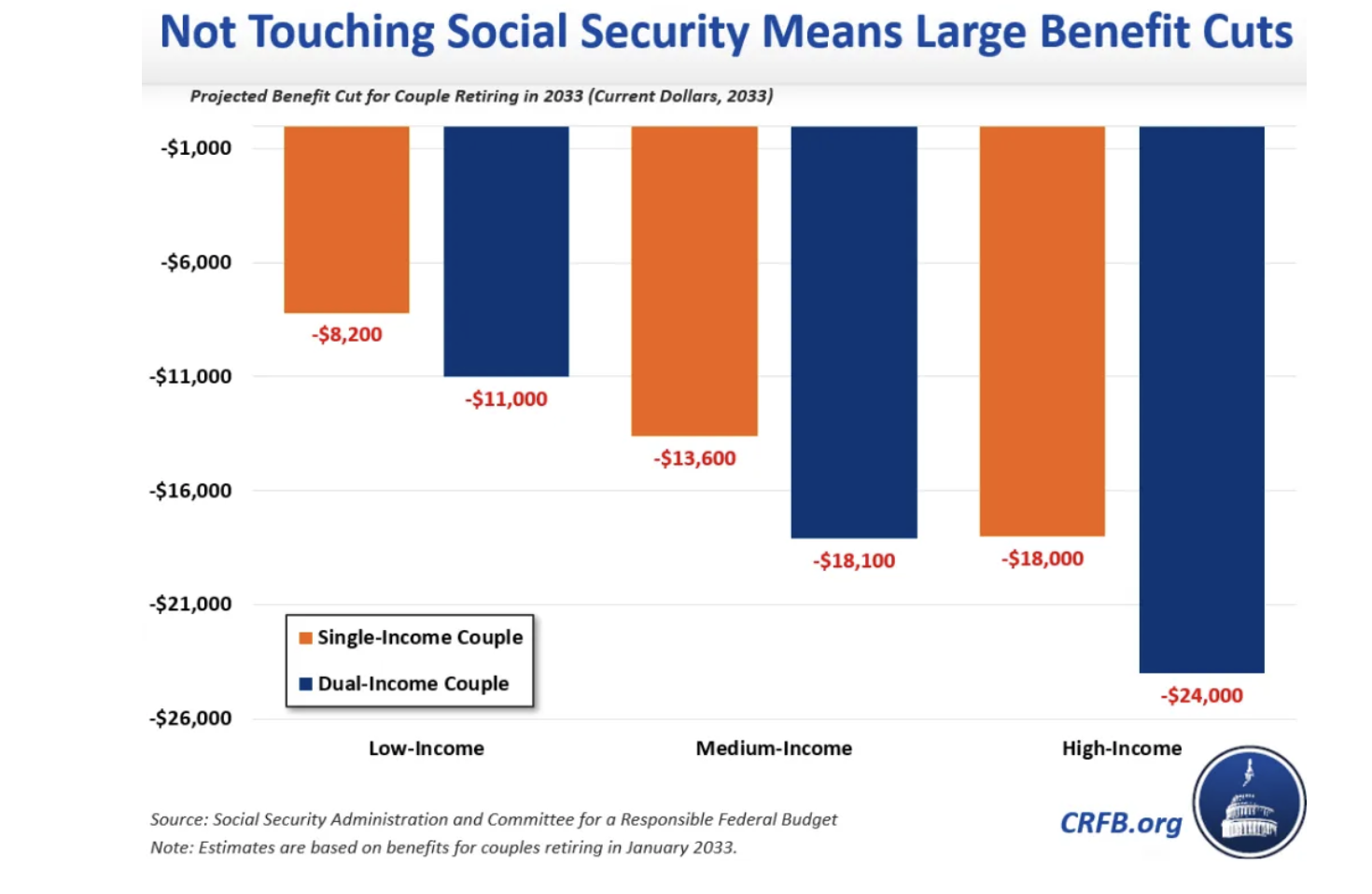

Last month, the Trustees of the Social Security projected that the Old-Age and Survivors Insurance (OASI) trust fund is eight years away from insolvency- a shortfall that the Committee for a Responsible Federal Budget (CRFB) warns could result in a 24% cut in benefits, or about a $18,000 loss for retirees annually in the coming years.

In the CRFB report, the One Big Beautiful Bill Act (OBBA) is mentioned as the law that dictates that once a trust fund like the OASI is depleted, benefits must be solely paid from incoming payroll tax revenue.

“We estimate that this would be equal to an $18,100 annual benefit cut for a dual-earning couple retiring at the start of 2033- shortly after the trust fund insolvency,” the report states. “At the same time, those retirees might experience reduced access to health care due to an 11 percent cut in Medicare Hospital Insurance payments. The cuts would grow over time as scheduled benefits continue to outpace dedicated revenues.”

The size of this cut would vary based on factors such as age, marital status, and work history. Households that are lower and single income would face smaller reductions, while high income couples could see cuts approaching $24,000 per year. If current trends continue, the CRFB estimates benefit cuts would exceed 30% by 2099. “Policymakers pledging not to touch Social Security are implicitly endorsing these deep benefit cuts for 62 million retirees in 2032 and beyond,” the report concludes.

Leave a Comment

You must be logged in to post a comment.